Transparent, superior equity models at Backtick

Oskar Handmark

Founder & Venture lead

If you've ever worked in the consulting industry, you've probably seen that people are compensated differently for the same competence or even the same position. One such case is when consultants work at different consultancy companies but ultimately at the same customer on the same project. Compensation varies - companies simply think differently about employees, margins, profits, salary negotiations, partner agreements, management overhead and shareholder dividends.

Data scientists, software engineers and IT professionals are some of the greatest beneficiaries of the current market and digital age. With information and opportunities being so easily accessible, switching jobs is no sweat. It is the most effortless and convenient way to bump one’s salary, especially in the consulting space where you can keep your actual job, even if you change consultancy company1.

Companies struggle with employee retention as a result which leads to inefficiencies and unsatisfied customers. This job hopping, context switching phenomenon effectively wastes competence and capacity that the world could use for better things2.

Conversely, If you’ve ever worked in the startup industry, job hopping isn’t as alluring. It’s a long term commitment. As such, you’re very likely to have experienced the negotiation affair of equity vs salary. For the uninitiated, the discussion is based upon the fact that a startup’s most scarce resource is money (at least early on). The proposition is that you work for the startup for a reduced salary and instead you’re offered equity as part of the compensation. This seems like a fair tradeoff and the exact compensational skew varies from startup to startup and depends on how early you join. The same goes for how much equity you get. If you come in early (as a non-founder), equity around 5-15% is common depending on your skill and responsibility in the company. If you join later (perhaps after initial funding), figures are around 0.1%-5%, as startups typically leave a pool around 5-10% for future employees.

Another caveat unfolds when you learn that in order to make you beholden to your duties, you are rarely given the shares directly. Instead, an agreed amount of options is allocated to you that allows the purchase of shares in the future. Shares may also come with vesting, meaning you have to stay with the company for a few years after getting your first shares, in order to convert all options to shares.

Hence, in order to have a realistic shot of ever making some real money in a startup you

have to truly believe that the startup will succeed

need to join early enough so that you get enough equity (don’t forget possible dilution of shares, 5-20% per investment round).

need to stay for the cliff and vesting period - typically a few years

To make things worse, most startups fail, about 90%. This number is usually taken from statistics in the US, but is true for Europe as well. Some data from techcrunch and Crunchbase suggest that 15-16% of seed invested startups end up being acquired3.

Let’s assume you don’t care whether or not you get rich or absurdly rich. Given the chances of succeeding above, you pick the 1 in 6 chance (15%) instead of the 1 in 10 chance. You join after a seed round and get 1% equity in options that take 4 years to completely convert and let’s assume we reach exit after 4 years (for simplicity, obviously this would be a distribution of some sort). On average, it would take you 24 years (4*6) to succeed.

From a purely mathematical standpoint, 4 years spent in a startup would be better utilized if you could work on 6 startups at the same time, with ⅙ of the effort. Of course, this isn’t feasible. You lose your tempo and timing, and no startup would let you work on 6 different projects simultaneously. The general advice is to do one thing, and to do that once thing exceptionally well. But what if you could parallelize things - say, create duplicates of yourself so that there are 6 of you, working full time on all projects? You would tremendously reduce your risk and instead of accomplishing one successful startup in an average of 24 years, you would produce one every 4 years, with ⅙ of the upside.

The most common investment tip is to spread your risks, and not invest everything into the same company. For some reason, this advice generally only applies to how we invest our money, not our time. Investment companies succeed4 not because they’re at the top of the food chain, but because they have the opportunity to spread risks across multiple investments. Engineers don’t. So with that in mind, consider spreading your risks with your time, not only your money5.

Consider if there were six copies of you, except five of them aren’t you. This means that there is one of you, and five others. Let’s call these five other people your colleagues, but they work in separate companies. Everybody gets ⅙ of the shares in each others companies. If you believe these five colleagues would perform equally well as yourself, you have, on average, created a successful startup in 4 years, with ⅙ of the upside (without having to duplicate yourself!). Congratulations!

At Backtick we’ve simply incorporated this concept into our strategy. We give employees shares in our holding company which owns Backtick’s subsidiaries and shares in other companies. Backtick can take equity in other companies in a few different ways:

Hard cash investments functioning as a “normal” investment. Backtick’s size and liquidity limits how much we can invest and at what stage.

Creating new companies from internal projects.

Building new products by offering our clients to build what they need help with as a product for them for free. In return the customer prepay a license and we try to build a general product for multiple customers instead of a very specific one. This ends up being cheaper for the client, since we stake the initial investment in product development.

Joint ventures with customers and partners (creating new companies together with another company).

Sweat equity, meaning we invest in a startup by subsidizing our consultancy hours in exchange for equity6.

By working this way, we not only reduce our risk by spreading our investments, we also lay a foundation for building startups. The main reason why startups fail is because they build products nobody wants7. We have the advantage of already being in the market, listening to customer needs and user feedback while having great relationships with our clients. We build companies with, and for our clients - meaning that there’s already a user need and somebody is ready to pay for the product. If we find that after some market research, multiple companies are interested in this, we have a clear signal to build it.

To summarize, Backtick acquires equity in other companies, and employees at Backtick acquire equity in these other companies, by acquiring equity in Backtick.

From an employee perspective, this is rather straightforward. Employees get the benefit of shares in Backtick. You spread your risks by trusting that your co-workers will work equally hard to succeed, and it’s enough that more than ⅙ of you succeed, sharing the upside. To finalize and give you some concrete numbers, here’s how it works:

We’ve reserved a pool of 7% equity in Backtick for our employees - we see this increasing to 10% over the coming years to accommodate more people joining our team.

Shares are given as options (specifically as KPOs, which is tax-beneficial version of employee options in Sweden) with 3 years vesting, primarily for tax reasons, but also to build mutual trust.

You get shares in Backtick Valley, our holding company. No shenanigans.

Employees get a great salary while working at Backtick, meaning you don’t have to trade salary for equity.

If you start or lead a project in Backtick Valley, you acquire personal shares in that company, should it become a promising venture and warrant the creation of a new company.

We finance this model through other consultancy work, without equity incentives.

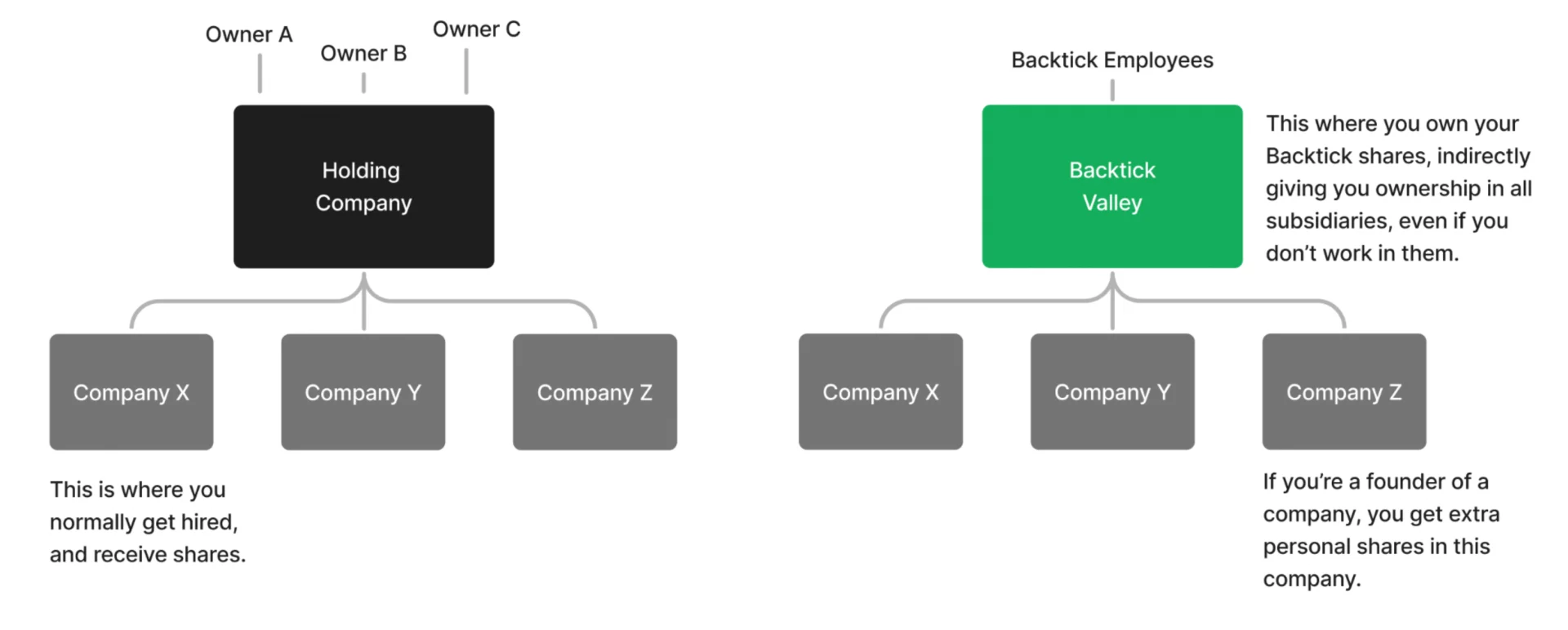

What’s unique about this concept is that we accomplish profit sharing through ownership. Ownership in our holding company. The most common and traditional setup is that business owners keep all shares in a holding company to themselves, and then hire people to subsidiary companies which is where employees get their shares. Of course, this doesn’t enable de-risked financial independence, so at Backtick, we’ve decided to give employees shares directly in our holding company.

If this doesn’t make sense to you, here’s an illustration to explain how we’re different:

To the left: traditional ownership structure. To the right, a truly transparent and

derisked profit sharing ownership model.

To the left: traditional ownership structure. To the right, a truly transparent and

derisked profit sharing ownership model.

The reason why you don’t find this at many other companies is simply because the owners don’t care about great engineers other than seeing them as necessary pieces to build products. They see them as employees rather than partners. At Backtick, we see all our engineers as partners, and partner retention is key. We want to work with the best engineers out there, and to do that, we believe in transparency, honesty, and hard work. It is a de-risked startup route with lower to-the-moon chances, but higher expected value. And we’d love to have you on board. If you think this sounds interesting, come work with us.

Notes

- 1. Say for example if two consultancy companies have consultants at the same client, switching company to work for nets you a salary increase, while not changing anything about your life drastically, because you still work for the same client.

- 2. I know, I know, that’s a bit of a stretch - but this idea keeps coming back every now and then. Let’s get back to the topic - equity models.

- 3. Yes, these numbers do indeed seem contradictory (10% vs 15%), but it all depends on what data you use and where you start and stop measuring. Acquisition data assumes your startup raised seed money, the other sources may not - so they can in fact be true at the same time.

- 4. Well, not all of them do, but making money when you already have money is easier than starting from nothing.

- 5. There’s a proverb from Don Quixote by Migual Cervantes that has something to do with eggs and baskets, dating back to 1605.

- 6. Honestly, we don’t believe in this, but it makes the list longer. The setup is flawed from the start. Sweat equity gives the consultancy company the wrong incentives. If it is truly a win-win-win (startup, consultancy, investor), why not just invest hard cash in the company and then let the startup choose consultants on the free market. If your offer is as great as you say, they would buy it from you anyways.

- 7. Yeah, I wish I had a source for this, but you’ll just have to take my word for it based on random things I scrambled from the internet and real life experiences.

Published on January 11th 2023

Last updated on April 13th 2023, 21:13

Oskar Handmark

Founder & Venture lead